MasterTrak | Applications | Overview | Resources | Related Links | About MRA | Contact Us

|

|

The MasterTrak© Payroll Processing

application provides a tool to enable the preparation, management and control

of the organization payroll. This application

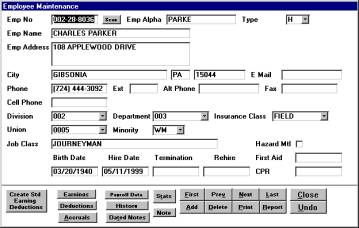

allows the user to maintain master records for employees, assign earnings and

deductions to employees, enter time cards, process the payroll by pay period,

print a payroll register and print payroll checks.

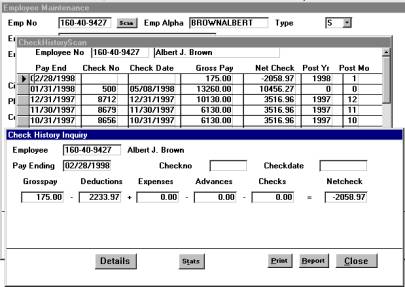

The payroll application maintains a history

by employee and pay ending date of all earnings and deductions. In addition appropriate entries to the

General Ledger and Job Cost are made.

At the end of the month, quarter and year, reports on the status of

employee’s tax, FICA, Unemployment and Workman’s compensation can be

printed. Annuity and deduction records

may also be established to allow for the reduction of taxable gross for 401K or

cafeteria benefits programs. Accruals

for vacation and sick time can be established for each employee.

General

Capabilities

Unlimited

earnings categories Multiple

rates Package

rates by job

Unlimited deductions Employer

contributions Job

burden rates

Tax Tables for Federal/State Print Checks Employee

Check History

Link to Job Cost Non tax

earnings supported Print

W-2’s

Multiple pay periods open Manual check override Payroll Register

Check Reconciliation Direct Deposit Recurring

Time Entry

Master Files and

Transaction Entry

Employee Earnings Deductions

Accruals Annuities Employee

Earnings

Employee Deductions Employee Annuities Employee Accruals

State Insurance (Work Comp) Time Entry Batches Manual Deduction

Batches

Manual Check Batches Expense/Advance Batches Recurring Time Cards

Reports

|

|

Payroll Register Certified Register

MTD

GL Distributions Transaction Journals

Earnings

Summary Deduction Summary

Union

Reporting Labor Summary by Job

Monthly

Report Quarterly Report

Year End Report W-2 Audit and W-2’s

Employee Check History